|

The old adage "you can't get something for nothing" applies when it comes to tax-exempt benefits programs and nondiscrimination testing. Here's an overview. One of the most attractive features of group-sponsored benefit plans is their tax-exempt status. Employers offering coverage can log their expenses as tax deductions. Employees paying their share of premiums through an employer’s cafeteria plan can do so with pre-tax dollars. As with any tax break offered by the IRS, there are some hurdles that must be met. For group-sponsored benefits, the hurdle is passing nondiscrimination testing - the plans cannot discriminate in favor of Highly Compensated Individuals (HCI) and/or key employees. The List is Long There are a number of nondiscrimination tests required of a benefits program. Some benefits need to pass more than one set of tests, which makes it even more complicated. If an employer offers a tax-free benefit to their employees, you can bet a test will be required.

Outside of the context of this article, there are other nondiscrimination tests to be aware of, including, but not limited to:

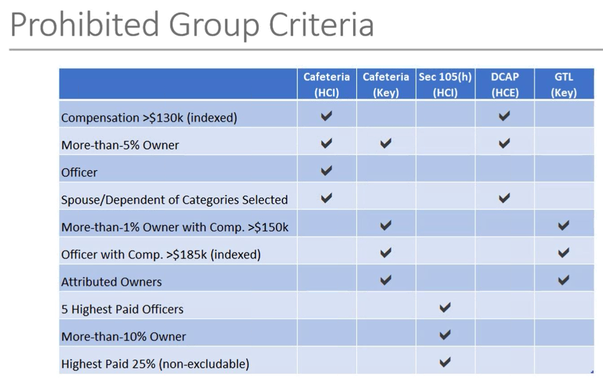

No Different Strokes for Different Folks Unfortunately, each of the nondiscrimination tests seem to use different definitions of highly compensated and Key employees, making the testing that much more complicated, especially when a program is subject to more than one test. In a recent NAHU webinar, Dr. Ramesh Raghunathan from CXC Solutions summed up the differences in a table: I highly recommend this webinar – it is one of the best that I have watched in years. You do need to be a member of NAHU to have access. The Self-Insured Pitfall Section 105(h) nondiscrimination testing applies to self-insured plans. This not only includes health plans, but also health flexible spending accounts and health reimbursement arrangements. You may remember that the Affordable Care Act expanded this testing to include fully insured plans, but thankfully that requirement has been on hold for more than a decade waiting for additional clarification. In my opinion, this is one of the strictest nondiscrimination tests. The plan must pass two tests, one being a benefits test. Under this test, the plan must not offer different benefits, employer contributions, or waiting periods to different eligible classes. Failure to pass nondiscrimination testing will not impact nonHighly Compensated Individuals (NHCI) and the overall plan will retain its tax-favored status. However, any health reimbursements (including payments to health care providers for covered services) under the failing self-insured plan become taxable income to all defined HCIs. The most common misstep I see is when a plan moves from fully-insured to level-funded. Since level-funded plans are categorized as self-insured in the eyes of nondiscrimination testing, care must be taken to ensure that the new plan complies with this basic benefits test under Section 105(h). Additional Resources We have a number of articles outlining the specifics of various nondiscrimination tests (NDT). Check them out here: The Bottom Line It is never fun for an employer to have to announce to HCIs and Key employees that they need to pay taxes on benefits. Worse are the penalties and interest that can accumulate if an employer never does their testing and the IRS/DOL uncover the issue during a benefits audit. Employers rely on their benefits consultant to ensure that they are complying with regulations. Therefore, understanding the nondiscrimination testing requirements is the first step toward walking your clients through the minefield. Be Benefits Informed

At The Benefits Academy, our mission is to bring you tools and resources to help you be a more effective benefits professional. We have a number of free offerings to keep you up to date:

0 Comments

Leave a Reply. |

This section will not be visible in live published website. Below are your current settings: Current Number Of Columns are = 1 Expand Posts Area = Gap/Space Between Posts = 10px Blog Post Style = card Use of custom card colors instead of default colors = Blog Post Card Background Color = current color Blog Post Card Shadow Color = current color Blog Post Card Border Color = current color Publish the website and visit your blog page to see the results About SandyI love numbers. I'm a math geek. I read benefits industry articles and periodicals for relaxation (but, honestly, I'm still a fun gal). I also like to share what I've learned and you'll find it all here.

�

Archives

September 2023

Categories

All

|

Services |

Company |

|

RSS Feed

RSS Feed