|

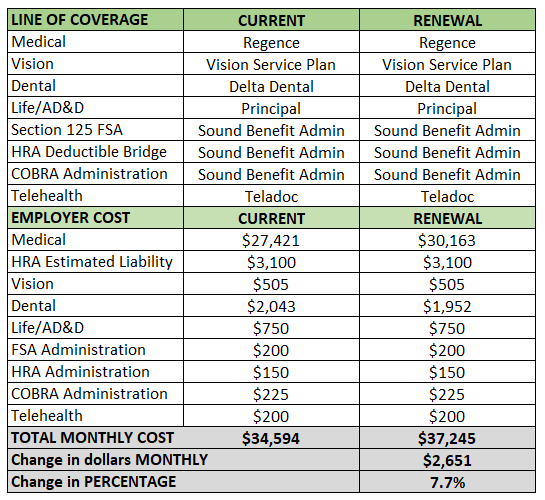

For many things in life, it's important to take a holistic view of a given situation to make sure goals and objectives are met. Here are some ideas for applying this line of thinking to your client's benefit plan renewals. These last few months I have been dealing with water intrusion issues in my condo development. After reviewing the multiple recommendations of various contractors, the HOA Board has finally agreed to bring in a consultant. What does this have to do with benefits? Let me explain. Each contractor provided their best guess as to why water was entering my neighbor’s ground floor unit. The window contractor felt it had to do with the window joists, the stucco guy thought the stucco was compromised, the foundation guy wanted to reseal the entire perimeter since that had to be the issue, and an engineer posited that it was the settling of a structural beam. Who knows, it could be a little bit of each issue contributing to the overarching problem. Now we are bringing in a “Building Envelope Inspector” to help us see the forest for the trees. This often happens when dealing with benefits, too. When a client’s medical plan rates are going up 10% and they only budgeted for 6%, everyone gets laser-focused on the medical plan – bid it out to the market, change the plan design, put in a skinny network. Just get that rate down. But if you look at just that one insurance plan, you miss the global solution to the client’s benefit problem. Regardless of size, every employer should review their benefits program as a forest. In fact, pruning in one area might bolster the rest of the foliage. A true benefits consultant takes all the client’s benefit programs into account when reviewing the renewal, developing goals, and recommending solutions. Total Cost Consciousness In my opinion, a benefits consultant’s main role is to bring “large employer thinking” to clients of any size. The first step in this process is to provide a roll-up of insurance and non-insurance benefits expenditures when reviewing a client’s renewal. This review should include all benefits where there is an employer cost: medical, telehealth, dental, vision, life, disability, worksite, pet coverage, ID theft assistance, etc. It should include the costs associated with FSA, HSA, HRA, and COBRA administration. If the employer has an HRA, or contributes to an FSA or HSA, include the estimated employer liability as well. The spreadsheet should include only the employer portion of the premiums, contributions, and fees. This provides a true picture of their overall benefits program renewal.

The Typical Cost Cutting Strategies Before we delve into “out of the box” strategies, let’s do a quick review of the tried-and-true tactics that most agents gravitate towards. Benefits consultants typically start with these plan strategies, which can be broken into medical plan tactics and other go-to strategies: Medical Plan Tactics

These are obvious choices, but they may not be the best – or only - course of action given the client’s objectives and goals. Out-of-the-Box Thinking There are a number of other strategies that can be explored when trying to shave percentage points off of a benefits program renewal. Here are just a few, and will depend on the current plans inforce:

The Bottom Line As you prepare for your client’s renewals, remember to view the process holistically, taking into account a client’s goals and objectives, their employee population and the entire benefits package costs and offerings. Do a deep dive every year and tweak as necessary. This methodology provides more benefits stability, which has advantages for everyone. For employees, constantly increasing their cost for health services can sour them on the benefits program. Moving from one carrier to another year after year not only worries employees who may need to change providers, it also worries the insurance marketplace as underwriters wonder how long your client will stay with them after the high cost of that first-year implementation. There will be times that the medical-only tactics are the right foliage to trim. But, maintaining good forest stewardship and exploring other solutions can provide the added value that your client is sure to appreciate in their benefits consultant. Be Benefits Informed

At The Benefits Academy, our mission is to bring you tools and resources to help you be a more effective benefits professional. We have a number of free offerings to keep you up to date:

1 Comment

7/13/2020 07:37:01 am

How do you see the below strategy evolving with the changes in the Wa. laws for fully insured as of 1/1/21 and the move of several large self-funded plans to include telehealth/virtual health at 100%?

Reply

Leave a Reply. |

This section will not be visible in live published website. Below are your current settings: Current Number Of Columns are = 1 Expand Posts Area = Gap/Space Between Posts = 10px Blog Post Style = card Use of custom card colors instead of default colors = Blog Post Card Background Color = current color Blog Post Card Shadow Color = current color Blog Post Card Border Color = current color Publish the website and visit your blog page to see the results About SandyI love numbers. I'm a math geek. I read benefits industry articles and periodicals for relaxation (but, honestly, I'm still a fun gal). I also like to share what I've learned and you'll find it all here.

�

Archives

September 2023

Categories

All

|

Services |

Company |

|

RSS Feed

RSS Feed